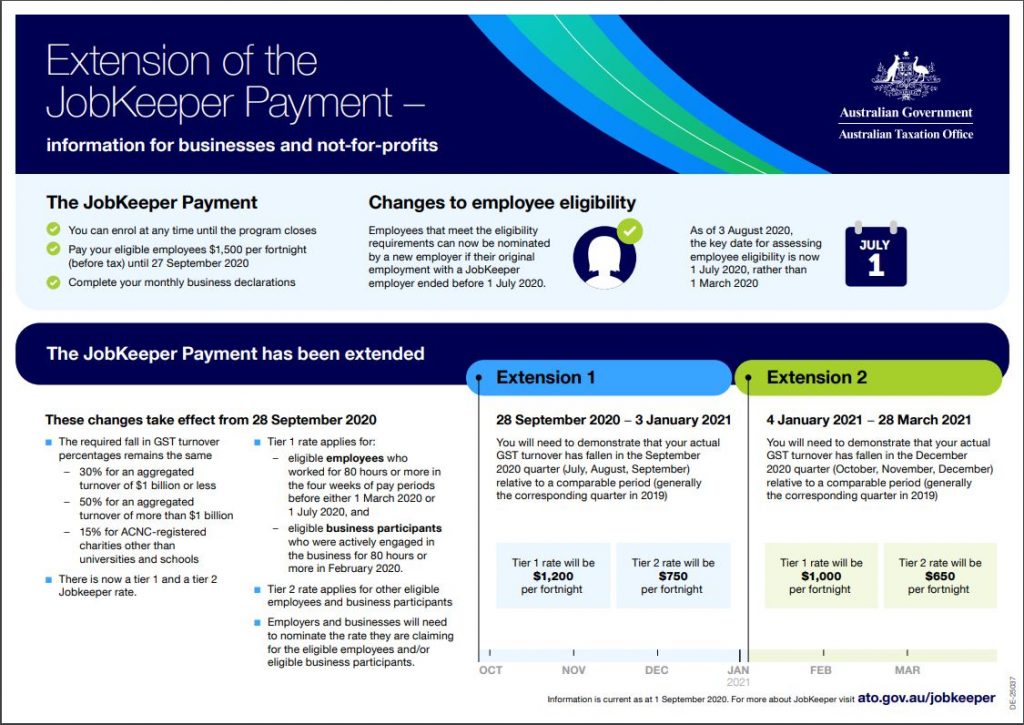

When calculating your eligibility for JobKeeper beyond 28th September, the ATO have advised that your GST method of reporting must be used to determine if your turnover has declined by 30%.

This means that if you used the Cash or Accrual method to prepare your BAS for the September 2019 period, then you must use the same method to calculate the September 2020 BAS for the JobKeeper eligibility test.

For example, you must use your G1 (Sales inc GST) less 1A (GST Received) September 2019 quarterly BAS figures compared to your September 2020 quarterly BAS figures if you use the Accrual method.

If you find that you are eligible for JobKeeper Extension, please refer to the ATO website for the new Payment Rates and other important information :

https://www.ato.gov.au/General/JobKeeper-Payment/Payment-rates/

Should you require any assistance to determine your eligibility, rates or registration, please do not hesitate to contact our office on 8212 2366.