Catch up contributions may be available to taxpayers who have a total balance in superannuation of less than $500,000 at the end of the previous financial. If they qualify, they may be able to utilize their unused concessional contributions cap and make catch up concessional contributions.

These measures were introduced in 2018 and the first year a member may make a catch-up contribution was the 2019/2020 financial year. Five years is the maximum any unused contribution cap amounts can be carried forward.

These measures benefit those with intermittent working patterns such as those who are self-employed or those who go on maternity and paternity leave for a period of time and then re-commence full time work in the future.

Other strategic tax planning opportunities lie with making personal concessional contributions in the year of a large capital gain to negate the potential tax payable or using those on lower tax rates such as adult children as a way of offsetting trust distributions.

Careful planning needs to be undertaken to ensure the person has enough taxable income to deduct the additional concessional contributions against.

Division 293 tax consequences maybe another issue for consideration in making a catch up payment of concessional contributions. Division 293 tax applies if the person’s adjusted taxable income in the year of contribution is above the $250,000 threshold.

The following example, demonstrates how the catch-up concessional contributions would work practically:

Example:

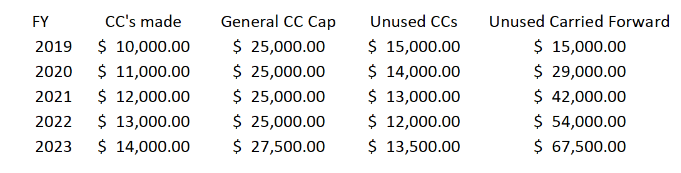

Phillip is 54 and has $350,000 in his super fund and considering making additional concessional contributions into that fund in the 2023/2024 financial year, as he has sold an investment property with a large capital gain and would like to use the contributions to reduce his taxable income. His concessional contributions in the prior years and unused amounts accrued since 2018/2019 are summarized below:

Based on the above information, Phillip could contribute catch up concessional contributions of $67,500, plus the 2023/2024 annual cap amount of $27,500, meaning a total of $95,000.

The information provided does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances.