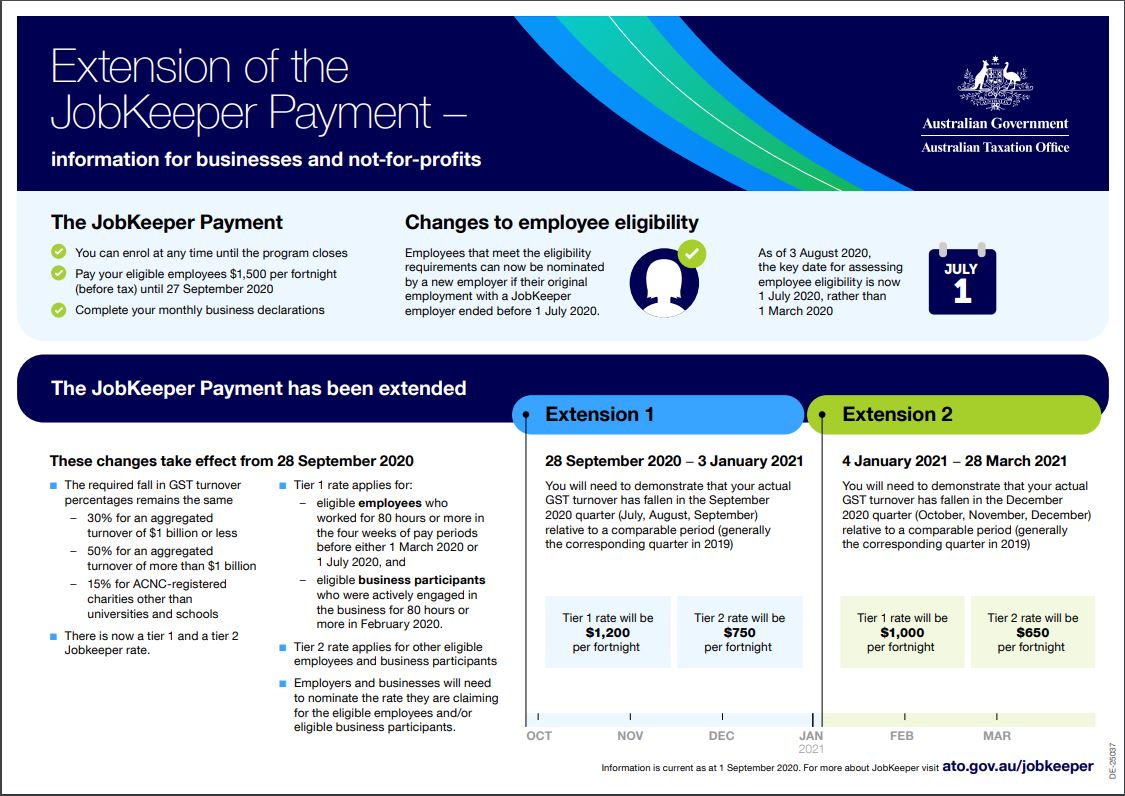

The Jobkeeper Extension No. 2 period will run from Monday 4th January 2021 to Sunday 28th March 2021

In order to determine if you are eligible for Jobkeeper Extension No. 2, you must be able to demonstrate that your actual GST turnover has declined by the required percentage* in the December 2020 quarter, relative to the same period in 2019.

Additionally, you must ensure you pay/have paid eligible employees according to the applicable tier rate.

For those employers or businesses that meet the JobKeeper decline in turnover test for the December 2020 quarter (being October, November, December), the JobKeeper payment will be decreased to:

- Tier 1 – $1,000 per fortnight before tax; and

- Tier 2 – $650 per fortnight before tax

We are encouraging clients to closely monitor their actual turnover to the end of December so that they are able to quickly determine their eligibility moving in to January.

The due dates for JobKeeper Extension Declarations are:

- JobKeeper Extension 1 – 14th January 2021

- Jobkeeper Extension 2 – 14th February 2021

Our office will close for the Christmas Break on 23rd December and re-open on 11th January 2021 – please consider this and contact us at your earliest convenience if you have been receiving or think you may need assistance from us.

* Most business are required to demonstrate a decline in turnover of at least 30%, ACNC Registered Charities need to show a decline of 15% or more, large business with a turnover of more than $1Billion are required to show a decline of at least 50%